Trailing Stop Loss: Lock in Profits Without Watching Charts

What Is a Trailing Stop Loss? (Quick Definition)

A stop trailing loss is an order that automatically adjusts to lock in profits as price moves in your favor. Unlike a standard stop loss that stays fixed at one price, a trailing stop follows the market upward (for long positions) but never moves backward.

Here’s the thing: most traders set a stop loss when they enter a trade and never touch it again. That’s better than nothing. But you’re leaving money on the table.

A trailing stop lets your winners run while protecting the gains you’ve already made.

How Trailing Stop Loss Orders Work

Think of a trailing stop as a protective floor that rises with you but never drops.

You buy Bitcoin at $40,000 and set a 10% trailing stop. Your initial stop sits at $36,000. Now Bitcoin climbs to $50,000. Your trailing stop automatically moves up to $45,000 (10% below the new high).

If Bitcoin then drops to $45,000, you’re out with a $5,000 profit. But if it keeps climbing to $60,000? Your stop moves up to $54,000.

The trailing stop only moves in one direction. It follows the market up but locks in place when prices fall. According to Charles Schwab’s trading guide, this is what makes trailing stops different from manual stop loss adjustments.

Trailing Stop Loss vs Standard Stop Loss

A standard stop loss stays fixed. You set it, and it sits there until triggered or canceled.

A trailing stop loss moves with you. It adapts to changing market conditions without requiring you to watch charts and manually adjust orders.

| Feature | Standard Stop Loss | Trailing Stop Loss |

|---|---|---|

| Price Movement | Fixed at one level | Moves up with price |

| Profit Protection | Limited to entry point | Locks in new highs |

| Monitoring Required | Manual adjustment needed | Automatic adjustment |

| Best For | Initial risk management | Maximizing winning trades |

The average trader spends 4-6 hours daily monitoring markets. A trailing stop does the work of constant adjustment automatically.

How to Set a Trailing Stop Loss (Step-by-Step)

Setting up a trailing stop takes less than a minute on most platforms. The harder part is choosing the right distance.

Step 1: Enter your trade (buy or sell).

Step 2: Locate the trailing stop order option (usually under “Order Type” or “Advanced Orders”).

Step 3: Choose your trailing amount (percentage or dollar value).

Step 4: Confirm the order.

Step 5: Let it work. Stop watching.

That last step is the hardest for most traders. Once the stop is set, trust the system.

Percentage-Based vs Dollar-Amount Trailing Stops

You have two options for setting your trailing distance.

Percentage-based trailing stops adjust relative to the current price. A 5% trailing stop on a $100 stock means a $5 buffer. On a $50 stock, it’s $2.50.

Dollar-amount trailing stops stay fixed regardless of price. A $5 trailing stop is always $5, whether you’re trading a $100 stock or a $500 stock.

For most traders, percentage-based stops make more sense. They scale with your position size and the asset’s price level.

What Is the Best Trailing Stop Loss Percentage?

The reality is: there’s no magic number that works for every asset.

The best trailing stop loss percentage depends on volatility. Tighter stops work for stable assets. Wider stops are necessary for volatile ones.

Recommended percentages by asset type:

- Large-cap stocks: 3-5%

- Mid-cap stocks: 5-8%

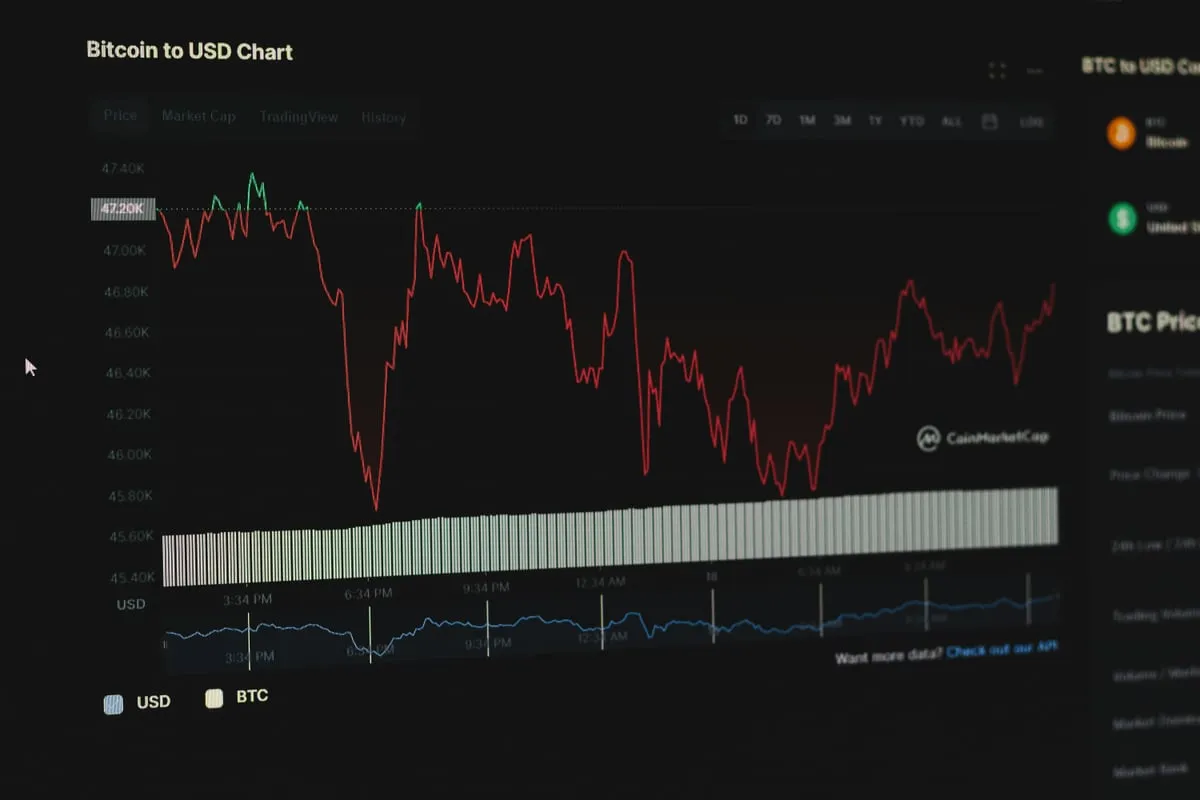

- Bitcoin and major crypto: 5-10%

- Altcoins and DeFi tokens: 8-15%

- Meme coins and low-caps: 10-15% (with smaller position sizes)

Research from Quant Investing found that stop-loss levels between 15-20% often produce the best risk-adjusted returns across different market conditions.

For crypto specifically, tight 1-2% trailing stops get triggered by normal volatility. According to trading platform BYDFi, 10-15% trailing stops work better for most cryptocurrency trades.

Set your stops based on market volatility. Wider during turbulent times, tighter in calm markets.

For a broader view of crypto trading strategies, see our beginner guide.

Trailing Stop Loss vs Stop Limit: Which Should You Use?

This is where traders get confused. Both sound similar, but they execute very differently.

Trailing stop loss: When triggered, it becomes a market order. You sell at whatever price is available. Execution is guaranteed; price is not.

Trailing stop limit: When triggered, it becomes a limit order. You only sell at your specified price or better. Price is protected; execution is not guaranteed.

| Feature | Trailing Stop Loss | Trailing Stop Limit |

|---|---|---|

| Order Type When Triggered | Market order | Limit order |

| Execution Guarantee | Yes | No |

| Price Control | No | Yes |

| Best For | Fast-moving markets | Gradual declines |

| Risk | Slippage in volatile markets | Order may not fill |

The SEC’s Investor Bulletin explains that during flash crashes, trailing stop limit orders may not execute at all because the price blows through your limit before any buyer appears.

For most traders, especially in crypto: Use trailing stop loss orders. Guaranteed execution matters more than perfect pricing when you need to exit.

Use trailing stop limits when: You’re trading highly liquid assets with tight spreads and aren’t worried about fast price gaps.

Let’s be honest: In a real market panic, you want out. A trailing stop loss gets you out. A trailing stop limit might leave you holding while prices collapse.

Why Most Traders Get Trailing Stop Losses Wrong

Setting a trailing stop isn’t the hard part. Letting it work is.

95% of retail traders lose money in their first year. Part of that comes from poor risk management. But a bigger part comes from overriding their own rules.

Common Mistakes That Trigger Premature Exits

Mistake 1: Setting the stop too tight.

A 2% trailing stop on Bitcoin will get triggered almost daily by normal price movement. Crypto can swing 3-5% in an hour during regular trading. You need room to breathe.

Mistake 2: Moving the stop manually.

You set a 10% trailing stop. The trade goes against you. Instead of letting the stop do its job, you move it wider to “give it more room.” This defeats the entire purpose of automated risk management.

Mistake 3: Removing the stop entirely.

The price keeps dropping. You convince yourself it will recover. You cancel the stop to avoid locking in a loss. This is how small losses become portfolio-killing disasters.

80% of day traders quit within two years. Many of them had good strategies that would have worked if they’d followed their own rules.

The Emotional Trigger Problem

Here’s what happens to most traders when a stop is about to trigger:

- They see the price approaching their stop.

- Panic sets in. “What if it reverses right after I sell?”

- They widen the stop or cancel it.

- The price keeps falling.

- They sell at a much bigger loss than planned (or hold until near-zero).

Studies show traders hold losing positions an average of 1.5 times longer than winning ones. We’re wired to avoid realized losses, even when that means accepting bigger unrealized ones.

The trailing stop exists to remove this decision from your emotional brain. But it only works if you let it.

If you want to dive deeper into trading psychology and emotions, read our emotionless trading guide.

Set It and Forget It: Automated Trailing Stop Loss for Busy Traders

You probably have a job. Maybe a family. Definitely a life outside of staring at charts.

The average trader spends 4-6 hours daily monitoring markets. That’s a part-time job. For most people with full-time careers, it’s unsustainable.

Automated stop loss systems solve this. Set your parameters once, and the system executes 24/7 without emotion, hesitation, or second-guessing.

How Trading Bots Handle Trailing Stops 24/7

Automated trading systems using infrastructure like Hummingbot have processed over $10 billion in trades. They don’t sleep. They don’t panic. They execute exactly as programmed.

Here’s what a bot does that you can’t:

24/7 execution. Crypto markets never close. A bot triggers your trailing stop at 3 AM when you’re asleep just as reliably as at 3 PM.

No emotional override. The bot doesn’t know fear. It doesn’t hope for recovery. When the stop triggers, it executes. Period.

Consistent parameters. Humans drift. After a few losses, you might tighten your stops or widen them based on recent results. A bot maintains the same strategy regardless of recent outcomes.

Speed. In fast-moving markets, a bot can execute in milliseconds. You’re still reaching for your phone.

Algorithmic trading now accounts for roughly 70% of institutional trading volume. The professionals automate because it works. Retail traders who automate their stop losses can access the same advantage.

See our guide to automated crypto trading for a full walkthrough.

Make Risk Protection Your Trading Edge

Let’s be honest: Most traders don’t fail because they pick bad trades. They fail because they can’t execute their risk management plan when emotions kick in.

A trailing stop loss is one of the simplest tools for protecting profits and limiting losses. It moves with you during winning trades and triggers automatically when the market turns.

The key is actually using it. Set appropriate percentages based on volatility (5-10% for crypto, 3-5% for stocks). Choose trailing stop loss over trailing stop limit for guaranteed execution. And most importantly: let the stop work without interference.

95% of traders lose money. Many of them had solid strategies. The difference between them and the successful 5% often comes down to consistent execution of risk management rules.

You can try to develop iron emotional discipline over years of trading. Or you can automate the decision entirely and remove emotion from the equation.

The choice is yours. But the market will keep testing your discipline either way.